Shockwave Medical Reports Third Quarter 2020 Financial Results

SANTA CLARA, Calif., Nov. 09, 2020 (GLOBE NEWSWIRE) — Shockwave Medical, Inc. (Nasdaq: SWAV), a pioneer in the development and commercialization of Intravascular Lithotripsy (IVL) to treat complex calcified cardiovascular disease, today reported financial results for the three months ended September 30, 2020.

Recent Highlights

- Recognized revenue of $19.6 million for the third quarter of 2020, representing a 73% increase over the third quarter of 2019

- Submitted PMA application for FDA approval of coronary IVL

- DISRUPT CAD III IDE study results of coronary IVL featured as a late breaking presentation at the TCT Connect conference

- DISRUPT PAD III peripheral trial results featured as a late breaking clinical trial presentation at VIVA20 conference

- Expanded the U.S. Field team to over 100 members

“The successes we achieved this quarter on the clinical, financial and operational fronts speak volumes in terms of confirming the value of our proprietary IVL technology for both coronary and peripheral indications and how it uniquely addresses the challenges our customers face when treating severely calcified arteries throughout the body,” said Doug Godshall, President and Chief Executive Officer of Shockwave Medical. “Our team has done a remarkable job of maintaining their focus on patients and physicians as we collectively work to navigate the challenges that 2020 has put in front of us all.”

Third Quarter 2020 Financial Results

Revenue for the third quarter of 2020 was $19.6 million, an increase of $8.3 million, or 73%, compared to the third quarter of 2019. The growth was primarily driven by sales force expansion in the U.S. and increased penetration in both U.S. and international markets.

Gross profit for the third quarter of 2020 was $14.3 million compared to $6.9 million for the third quarter of 2019. Gross margin for the third quarter of 2020 was 73%, as compared to 61% in the same period of last year. Contributors to gross margin improvement included continued improvement in manufacturing productivity and process efficiencies.

Operating expenses were $27.1 million for the third quarter of 2020 compared to $20.0 million in the corresponding prior year period, representing a 36% increase, primarily driven by increases in headcount since the year ago period.

Net loss was $12.9 million in the third quarter of 2020, as compared to $13.0 million in the corresponding period of the prior year. Net loss per share was $0.38 in the third quarter of 2020.

Cash and cash equivalents totaled $215.3 million as of September 30, 2020.

Impact of COVID-19 Pandemic and 2020 Financial Guidance

While we have continued to see positive trends in our business, we remain mindful of the potential negative impacts due to the current increase in case volumes globally. Given what we experienced in the second quarter due to the COVID-19 pandemic, and due to the uncertain scope and duration of the pandemic, the global resurgence of cases, and uncertain timing of a global recovery and economic normalization, we still cannot reliably estimate the future impact of the pandemic. As such, Shockwave is unable to estimate the pandemic’s impact on operations and financial results and is not issuing 2020 financial guidance at this time.

Conference Call

Shockwave Medical will host a conference call at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time on Monday, November 9, 2020 to discuss its third quarter 2020 financial results. The call may be accessed through an operator by dialing (866) 795-9106 for domestic callers or (470) 495-9173 for international callers, using conference ID: 9094859.

About Shockwave Medical, Inc.

Shockwave Medical is focused on developing and commercializing products intended to transform the way calcified cardiovascular disease is treated. Shockwave aims to establish a new standard of care for the interventional treatment of atherosclerotic cardiovascular disease through differentiated and proprietary local delivery of sonic pressure waves for the treatment of calcified plaque, which Shockwave refers to as Intravascular Lithotripsy (IVL). IVL is a minimally invasive, easy-to-use and safe way to significantly improve patient outcomes. To view an animation of the IVL procedure and for more information, visit www.shockwavemedical.com.

Forward-Looking Statements

This press release contains statements relating to our expectations, projections, beliefs, and prospects, including statements regarding our product development outlook, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” and similar expressions, and the negative of these terms. You are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements are only predictions based on our current expectations, estimates, and assumptions, valid only as of the date they are made, and subject to risks and uncertainties, some of which we are not currently aware.

Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others: the impact of the COVID-19 pandemic on our operations, financial results, and liquidity and capital resources, including the impact on our sales, expenses, supply chain, manufacturing, research and development activities, clinical trials, and employees; our ability to develop, manufacture, obtain and maintain regulatory approvals for, market and sell, our products; our expected future growth, including the size and growth potential of the markets for our products; our ability to obtain coverage and reimbursement for procedures performed using our products; our ability to scale our organizational culture; the impact of the development, regulatory approval, efficacy and commercialization of competing products; the loss of key scientific or management personnel; our ability to develop and maintain our corporate infrastructure, including our internal controls; our financial performance and capital requirements; and our ability to obtain and maintain intellectual property protection for our products, as well as our ability to operate our business without infringing the intellectual property rights of others. These factors, as well as others, are discussed in our filings with the Securities and Exchange Commission (SEC), including in Part I, Item IA – Risk Factors in our most recent Annual Report on Form 10-K filed with the SEC, and in our other periodic and other reports filed with the SEC. Except to the extent required by law, we do not undertake to update any of these forward-looking statements after the date hereof to conform these statements to actual results or revised expectations.

Media Contact:

Scott Shadiow

+1.317.432.9210

sshadiow@shockwavemedical.com

Investor Contact:

Debbie Kaster

dkaster@shockwavemedical.com

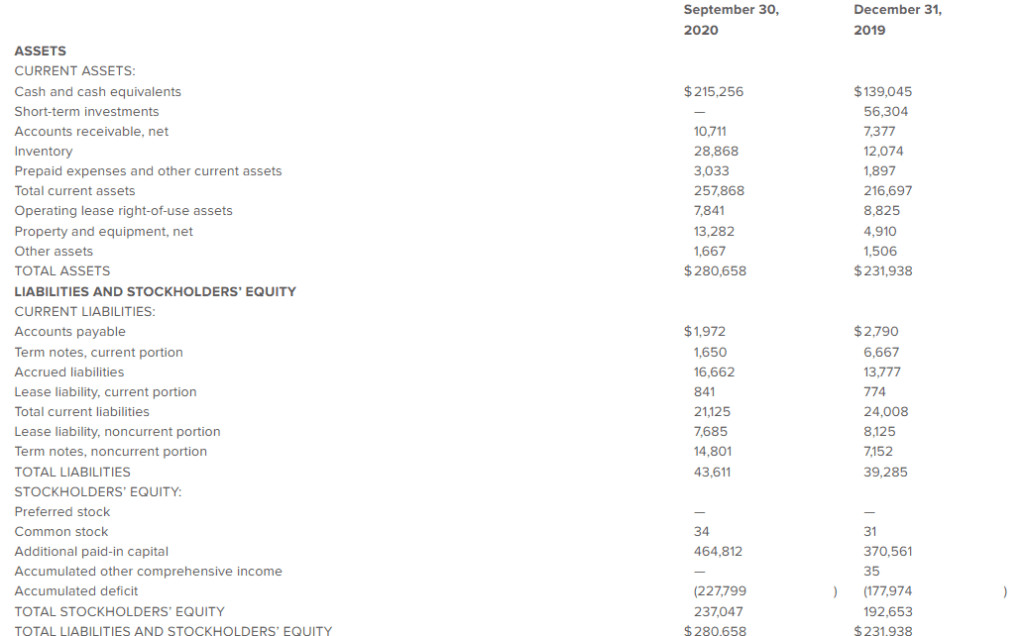

SHOCKWAVE MEDICAL, INC.

Balance Sheet Data

(Unaudited)

(in thousands)

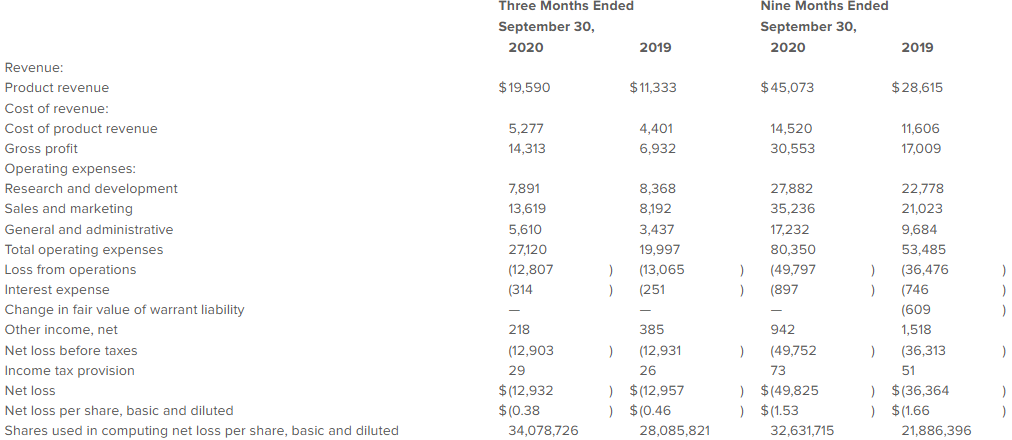

SHOCKWAVE MEDICAL, INC.

Statement of Operations Data

(Unaudited)

(in thousands, except share and per share data)